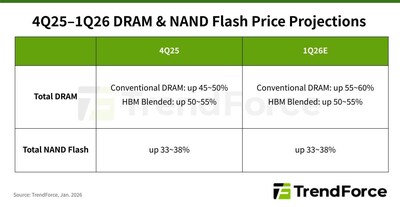

Memory Makers Prioritize Server Applications, Driving Across-the-Board Price Increases in 1Q26, Says TrendForce

- Conventional DRAM contract prices in 1Q26 are forecast to rise 55–60% QoQ, while NAND Flash prices are expected to increase 33–38% QoQ

- The DRAM supply-demand gap continues to widen as U.S.-based CSPs lock in capacity, forcing other buyers to accept higher prices; server DRAM prices are projected to surge by more than 60% QoQ

- NAND Flash demand is increasingly polarized between consumer and AI applications, with enterprise SSDs becoming the largest segment; client SSD prices are forecast to rise by over 40%

TAIPEI, Jan. 5, 2026 /PRNewswire/ -- TrendForce's latest investigations indicate that DRAM suppliers in 1Q26 will continue to reallocate advanced process nodes and new capacity toward server and HBM products to support rising AI server demand. This shift has significantly limited supply in other markets, causing conventional DRAM contract prices to increase by about 55–60% QoQ. Meanwhile, disciplined capacity management by NAND Flash suppliers, along with robust server demand that is displacing other applications, is likely to increase contract prices across all NAND Flash product categories by 33–38%.

Despite weaker notebook shipments and slower growth in memory demand due to potential specification downgrades, PC DRAM prices are still set to rise sharply in the first quarter. DRAM suppliers have simultaneously tightened supply to PC OEMs and module makers, forcing some OEMs to procure memory at higher prices through modules. This is expected to raise branded module pricing and significantly drive up PC DRAM prices.

AI inference-driven infrastructure developments are consistently driving procurement for U.S.-based CSPs. Since late 2025, these companies have been pulling in orders, creating increased demand for server DRAM. Backed by strong past purchasing trends and positive demand forecasts, they are gaining a larger portion of the bit supply growth from suppliers. Supply tightness continues to intensify with suppliers' inventories approaching depletion and shipment growth reliant solely on wafer output increases. As a result, server DRAM prices are expected to climb by more than 60% QoQ in 1Q26.

Although smartphone brands generally experience lower memory demand during the seasonal lull, the tight supply of mobile DRAM is unlikely to relax soon, and contract prices could increase further in the upcoming quarters. Consequently, brands are continuing to pursue strong procurement efforts in 1Q26. Both the LPDDR4X and LPDDR5X markets are expected to stay undersupplied with uneven distribution of resources, which supports higher prices.

Graphics DRAM demand has softened following downward revisions to Nvidia RTX 6000-series sales targets and shipment cutbacks by some PC OEMs. However, supply remains constrained by DDR5 capacity, which shares similar process technologies. This has led to continued price increases.

Despite tight overall DRAM supply, consumer buyers are prepared to pay more to secure priority access in 1Q26 and mitigate future shortage risks. Though, cautious capacity growth from some suppliers and the requirement to allocate output for higher-density products will keep supply below demand in the near term, supporting ongoing price increases.

AI to drive NAND Flash growth; enterprise SSDs to become the largest segment in 2026

TrendForce predicts that in 1Q26, client SSD demand will decline due to a QoQ drop in notebook shipments and the downgrading of some entry- and mid-range models to reduce BOM costs. Meanwhile, suppliers focused on profit maximization are shifting supply from client SSDs to data center SSDs. The availability of high-capacity, low-cost QLC products is especially limited. As a result, contract prices for client SSDs are expected to increase by at least 40% QoQ, marking the largest rise among all NAND Flash products.

The global server market is expected to reach its peak in 2026 as North American CSPs speed up investments in AI infrastructure. This growth is boosting demand for enterprise SSDs, making them the leading NAND Flash application segment. Supply is becoming tighter due to limited capacity and suppliers prioritizing profits and controlling shipments, which is driving up enterprise SSD prices.

In the eMMC/UFS segment, smartphone demand is weakening because promotional sales in the first half of 2025 have already accelerated consumption, and the market is moving into an inventory adjustment phase in the first quarter of 2026. As a result, smartphone shipments are expected to fall significantly QoQ.

Although Chromebook shipments might outperform due to government procurement programs, overall demand for eMMC/UFS remains weak. On the supply side, ongoing reductions in supply capacity—only partly compensated by module makers—continue to leave the market undersupplied.

For NAND Flash wafers, weak performance in consumer and retail markets, coupled with aggressive price hikes in 4Q25, is expected to dampen demand in 1Q26. At the same time, suppliers are prioritizing high-margin product lines, further squeezing wafer supply to module makers and sustaining upward price pressure.

For more information on reports and market data from TrendForce's Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

About TrendForce

TrendForce is a global provider of the latest development, insight, and analysis of the technology industry. Having served businesses for over a decade, the company has built up a strong membership base of 500,000 subscribers. TrendForce has established a reputation as an organization that offers insightful and accurate analysis of the technology industry through five major research divisions: Semiconductor Research, Display Research, Optoelectronics Research, Green Energy Research, ICT Applications Research. Founded in Taipei, Taiwan in 2000, TrendForce has extended its presence in China since 2004 with offices in Shenzhen and Beijing.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/memory-makers-prioritize-server-applications-driving-across-the-board-price-increases-in-1q26-says-trendforce-302652560.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/memory-makers-prioritize-server-applications-driving-across-the-board-price-increases-in-1q26-says-trendforce-302652560.html

SOURCE PRNA Audience (Ex-China)