TARGA ANNOUNCES EXPANSION OF DRILL PROGRAM AT OPINACA GOLD PROJECT

Werte in diesem Artikel

CSE: TEX | OTCQB: TRGEF | FRA: V6Y

VANCOUVER, BC, Oct. 7, 2025 /CNW/ - Targa Exploration Corp. (CSE: TEX) (FRA: V6Y) (OTCQB: TRGEF) ("Targa" or the "Company") today announced an expansion of the ongoing diamond drilling program at its Opinaca Gold Project ("Opinaca") located in the James Bay region of Quebec.

Highlights

- Drilling progressing ahead of schedule and under budget;

- 2,513m and five (5) drillholes completed as of the morning of October 6th;

- Approved expansion of drill program from 2,500m to 3,250m.

"Drilling has progressed very well at Opinaca," commented Targa CEO, Cameron Tymstra. "With five drill holes already complete we are comfortably ahead of schedule. The efficient work that Kenorland and Chibougamau Drilling are doing on site allows us to expand the drill program to include additional drill holes while maintaining the original budget. The goal of this program is to discover which bedrock lithology units are hosts to the gold that we have seen across an extensive area of till cover. The more holes we can drill, the greater our chances of discovery and we have already encountered several rock units of interest that are mineralized locally with up to half a percent pyrite, pyrrhotite, and arsenopyrite over broad intervals."

Drill Program Expansion

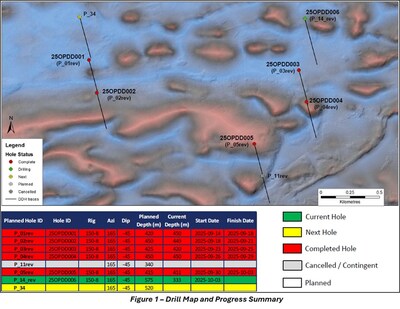

The maiden drill program at Opinaca is being expanded from 2,500m (see press release dated September 18, 2025) to approximately 3,250m and is currently scheduled to be complete by the 15th of October (Figure 1).

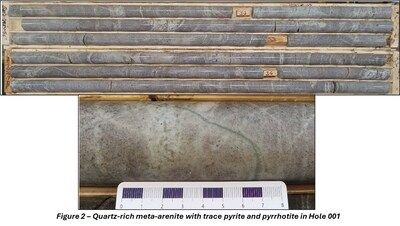

The first five of six drill holes originally planned at the start of the program have been completed ahead of schedule. The expanded plan will include the lengthening and movement of the sixth original hole further to the north. This hole is currently being drilled with a target depth of 575m and is collared in an area where multiple gold-bearing boulders were discovered in 2024. A seventh hole will be added to the north of Hole #1 with a target depth of 525m to target a quartz-rich meta-arenite unit mineralized with trace pyrite and pyrrhotite encountered in the top of Hole #1 and seen in outcrop north of Hole #1 (Figure 2). If time and budget permit, an eighth hole will be added to test the head of a till train at the eastern limit of the geochemical footprint or an alternate target.

In addition to the meta-arenite in Hole #1, several other mineralized intervals of note have been encountered in multiple drill holes. Sections of metawacke with two-toned bleaching halos containing very fine pyrite and trace arsenopyrite around thin quartz veinlets (Figure 3) have been drilled in Hole #2 and Hole #3. A 25m section of metawacke with 15% leucosome veinlets and local trace pyrite was also encountered in Hole #2 (Figure 4) which is located about 2km up-ice from a leucosome boulder sampled in 2024 that returned 0.6g/t Au (see press release dated November 25, 2024). All core samples will be delivered to the lab once drilling is complete, with assays results expected mid to late November.

About the Opinaca Gold Project

The Opinaca Project is located in the James Bay region of Quebec, approximately 45km south of the all-season Trans-Taiga Road and 140km northeast of the Eleonore gold mine. The Opinaca Project covers 85,267 contiguous hectares of the Opinaca geological sub-province, dominantly a metasedimentary region with neoarchean-aged igneous intrusions including of the Vieux Comptoir suite of granites. Till sampling and prospecting work in 2023 and 2024 has identified a 7km-long gold target trend near the center of the project. Boulder sampling in 2024 returned a dozen boulders with anomalous (>0.1g/t) gold values, including up to 6.7g/t Au. A recent airborne magnetic survey has identified a 4km magnetic anomaly at the center of the gold trend.

Qualified Person

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Adrian Lupascu M. Sc. P.Geo., Exploration Manager of Targa Exploration Corp., who is a "qualified person" within the meaning of National Instrument 43 -101- Standards of Disclosure for Mineral Projects.

About Targa

Targa Exploration Corp. (CSE: TEX | FRA: V6Y | OTCQB: TRGEF) is a Canadian exploration company engaged in the acquisition, exploration, and development of gold mineral properties with headquarters in Vancouver, British Columbia. Targa's principal asset is it's Opinaca Gold Project where a significant gold-in-till anomaly has been identified over a strike length of 7km.

Website: www.targaexploration.com

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward‐Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward‐looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "proposed", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: timing of completion of the drill program; number, location, and depth of drill holes; timing of exploration programs; and the exploration and development of the Company's properties.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Targa, future growth potential for Targa and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Targa's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Targa's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Targa has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: price volatility of gold and other metals; risks associated with the conduct of the Company's mineral exploration activities in Canada; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of public health crises; the economic and financial implications of public health crises to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in Targa's management discussion and analysis and other public disclosure documents. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Targa has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Targa does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Targa Exploration Corp.

Übrigens: Terex und andere US-Aktien sind bei finanzen.net ZERO sogar bis 23 Uhr handelbar (ohne Ordergebühren, zzgl. Spreads). Jetzt kostenlos Depot eröffnen und Neukunden-Bonus sichern!

Ausgewählte Hebelprodukte auf Targa Exploration

Mit Knock-outs können spekulative Anleger überproportional an Kursbewegungen partizipieren. Wählen Sie einfach den gewünschten Hebel und wir zeigen Ihnen passende Open-End Produkte auf Targa Exploration

Der Hebel muss zwischen 2 und 20 liegen

| Name | Hebel | KO | Emittent |

|---|

| Name | Hebel | KO | Emittent |

|---|

Nachrichten zu Terex Corp.

Analysen zu Terex Corp.

| Datum | Rating | Analyst | |

|---|---|---|---|

| 20.08.2018 | Terex Neutral | Robert W. Baird & Co. Incorporated | |

| 18.04.2018 | Terex Buy | Seaport Global Securities | |

| 13.12.2017 | Terex Equal Weight | Barclays Capital | |

| 02.08.2017 | Terex Buy | UBS AG | |

| 27.02.2017 | Terex Buy | Deutsche Bank AG |

| Datum | Rating | Analyst | |

|---|---|---|---|

| 18.04.2018 | Terex Buy | Seaport Global Securities | |

| 02.08.2017 | Terex Buy | UBS AG | |

| 27.02.2017 | Terex Buy | Deutsche Bank AG | |

| 14.12.2016 | Terex Buy | Stifel, Nicolaus & Co., Inc. | |

| 06.09.2016 | Terex Market Perform | BMO Capital Markets |

| Datum | Rating | Analyst | |

|---|---|---|---|

| 20.08.2018 | Terex Neutral | Robert W. Baird & Co. Incorporated | |

| 13.12.2017 | Terex Equal Weight | Barclays Capital | |

| 14.12.2016 | Terex Sector Perform | RBC Capital Markets | |

| 07.09.2016 | Terex Hold | Deutsche Bank AG | |

| 11.07.2016 | Terex Equal Weight | Barclays Capital |

| Datum | Rating | Analyst | |

|---|---|---|---|

| 24.10.2016 | Terex Underweight | Barclays Capital | |

| 09.10.2012 | Demag Cranes underperform | Cheuvreux SA | |

| 17.08.2012 | Demag Cranes verkaufen | Norddeutsche Landesbank (Nord/LB) | |

| 02.12.2011 | Demag Cranes verkaufen | Norddeutsche Landesbank (Nord/LB) | |

| 02.12.2011 | Demag Cranes verkaufen | Norddeutsche Landesbank (Nord/LB) |

Um die Übersicht zu verbessern, haben Sie die Möglichkeit, die Analysen für Terex Corp. nach folgenden Kriterien zu filtern.

Alle: Alle Empfehlungen